Corporate Tax Registration Starts in UAE – How to register?

Corporate Tax Registration Starts in UAE. All corporations are required to register with the Federal Tax Authority and obtain a Corporation Tax Registration ID. This applies to all businesses, regardless of the corporation tax rate they are subject to (0% or 9%). To ensure a smooth and hassle-free process, it’s advisable to seek assistance from professional corporate tax advisors in the UAE who can help with all aspects of tax registration

Corporate Tax Registration – Who can register for now?

- Private Companies, including Establishments.

- Public Joint Stock Companies.

Note: Information regarding registration for other legal entities and natural persons will be provided at a later date. (Click here for latest updates)

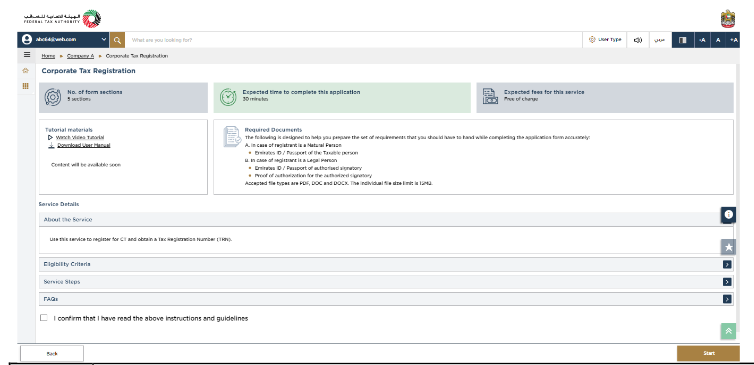

What do you need for the registration process?

- Legal structure and relevant documents for your business, such as a license and Memorandum of Association (MOA).

- Information and identification documents for the owners or authorized signatory, including Emirates ID and passport.

- Documentation to verify the authorization of the authorized signatory, such as the MOA and Power of Attorney.

Corporate Tax Registration : Where can you register?

Online through https://eservices.tax.gov.ae/

UAE Corporate Tax Return Filing

The FTA requires that businesses be allowed to file a single consolidated tax return, rather than requiring them to file multiple returns. This consolidated return must be filed within nine months of the end of each relevant tax period.

To find out more about e-filing corporate tax returns in the UAE, Please contact us : Saif Chartered Accountants, Dubai, UAE.

UAE Corporate Tax deadlines

The corporate tax regime is based on a self-assessment principle which means businesses are responsible for ensuring that the documents they submit to the FTA are correct and comply with the law.

The new UAE corporate tax regime allows taxpayers up to 21 months from the start of their financial year to prepare for filing and making their tax payments.

For example, businesses with a financial year starting on June 1, 2023, and ending on May 31, 2024, have until February 28, 2025 to file their corporate tax returns and make their payments.

For a business whose first tax period begins on January 1, 2024 and ends on December 31, 2024, the return and payment must be filed between January 1 and September 30, 2025.

Related : VAT Consultancy Service