Navigating Corporate Tax Return Filing in the UAE

Corporate Tax Return Filing in the UAE: In the realm of business operations within the UAE, adhering to corporate tax regulations is paramount to ensure compliance with local statutes. Failure to adhere to these regulations, including the timely submission of tax returns, can result in significant financial repercussions. The UAE government, acting through the Federal Tax Authority (FTA), mandates the punctual filing of corporate tax returns, underscoring the importance of meeting these obligations.

In the backdrop of evolving legislative frameworks, particularly with the introduction of corporate tax legislation by the Ministry of Finance in January 2022, businesses have encountered new mandates. Implementation, initially slated for either June 2023 or January 2024, has established a 9% headline tax rate effective June 1, 2023. Notably, entities with annual taxable profits below AED 375,000 enjoy exemption from taxation, aligning the UAE’s tax regime with international standards.

Central to the process is the obligation for all taxable entities to register for corporate tax and procure a unique Tax Registration Number (TRN). Even entities exempt from taxation may find themselves obliged to register for corporate tax at the discretion of tax authorities.

Unveiling Corporate Tax Return Filing in the UAE

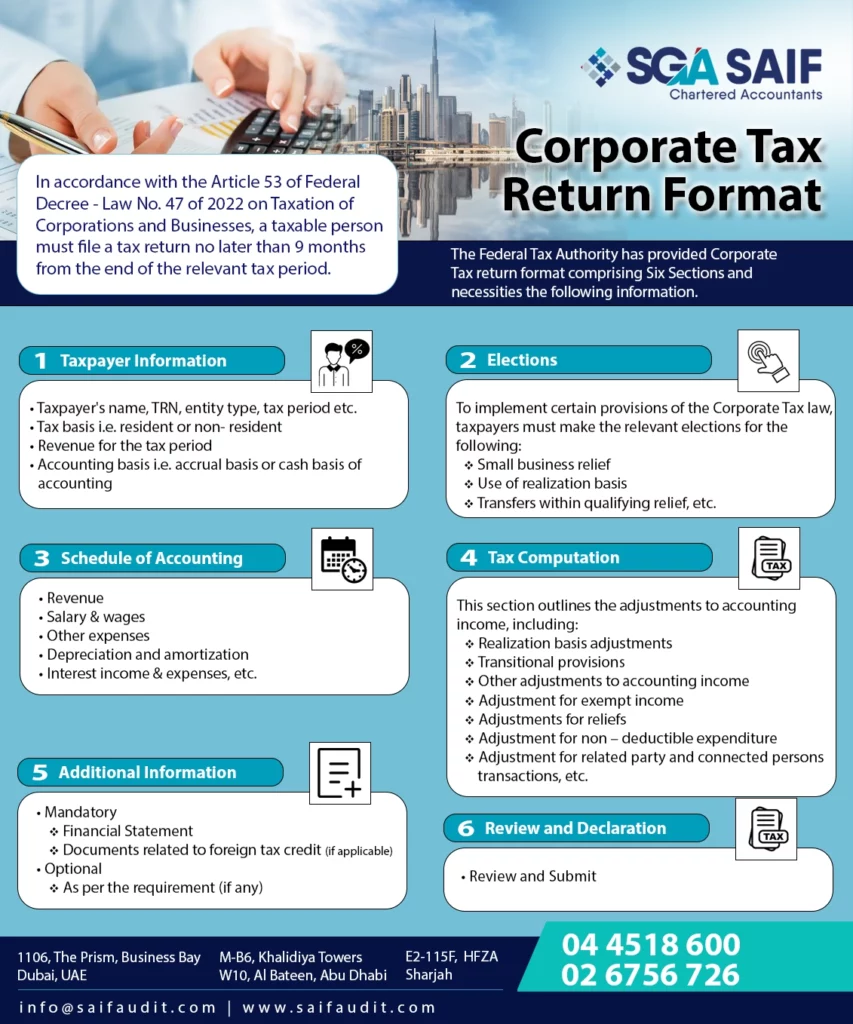

Corporate tax return filing in the UAE entails the submission of a meticulous report to the relevant tax authority delineating a company’s financial inflows and outflows. This Corporate Tax Return, filed by the Taxable Person for a designated tax period, meticulously outlines corporate tax liabilities and payment particulars. Compliance with the Corporate Tax Law necessitates timely submission of the Tax Return to the tax authority within prescribed timeframes.

Should the tax authority request supplementary information, documents, or records, it falls upon the taxpayer to promptly furnish these to ensure procedural compliance.

The Mandatory Nature of Corporate Tax Return Filing in the UAE

In the UAE, the filing of corporate tax returns is mandatory, as stipulated by the Federal Tax Authority (FTA). Businesses operating within the UAE are obligated to submit tax returns and settle taxes based on their taxable earnings in accordance with UAE tax statutes. However, entities with an income below AED 375,000 are subject to a 0% tax rate.

These regulations apply universally to both domestic and international enterprises operating within the UAE. Non-compliance, encompassing failure to file tax returns or remit taxes, may incur penalties and fines.

An Insight into the Corporate Tax Return Format

Following much anticipation, the corporate tax return format has been unveiled, featuring six comprehensive sections tailored to facilitate seamless tax filing:

- Taxpayer Information: Furnish precise and comprehensive details about the taxpayer to expedite the tax return processing.

- Elections: Exercise necessary elections aligned with business requisites to optimize the tax filing process.

- Schedule of Accounting: Present a coherent and structured schedule of accounting activities to facilitate efficient tax assessment.

- Tax Computation: Precisely compute taxes in adherence to the guidelines specified in the tax return format.

- Additional Information: Include any supplementary details or documentation requisite to support tax return filing.

- Review and Declaration: Conduct a thorough review of information across all sections before making a declaration and submitting the tax return to the Federal Tax Authority (FTA).

Ensuring accurate and comprehensive completion of each section is imperative to ensure compliance with tax regulations and preempt potential issues. Timely submission of the tax return to the FTA within stipulated timeframes is crucial.

Stay attuned for forthcoming updates and guidelines pertaining to corporate tax filing on our website. Should queries arise or assistance be required regarding tax return filing, do not hesitate to reach out. We stand ready to facilitate a seamless navigation through the process.