Voluntary Disclosure Form 211

VOLUNTARY DISCLOSURE FORM 211 -CORRECTING ERRORS ON YOUR VAT RETURN IN UAE

Voluntary Disclosure Form 211

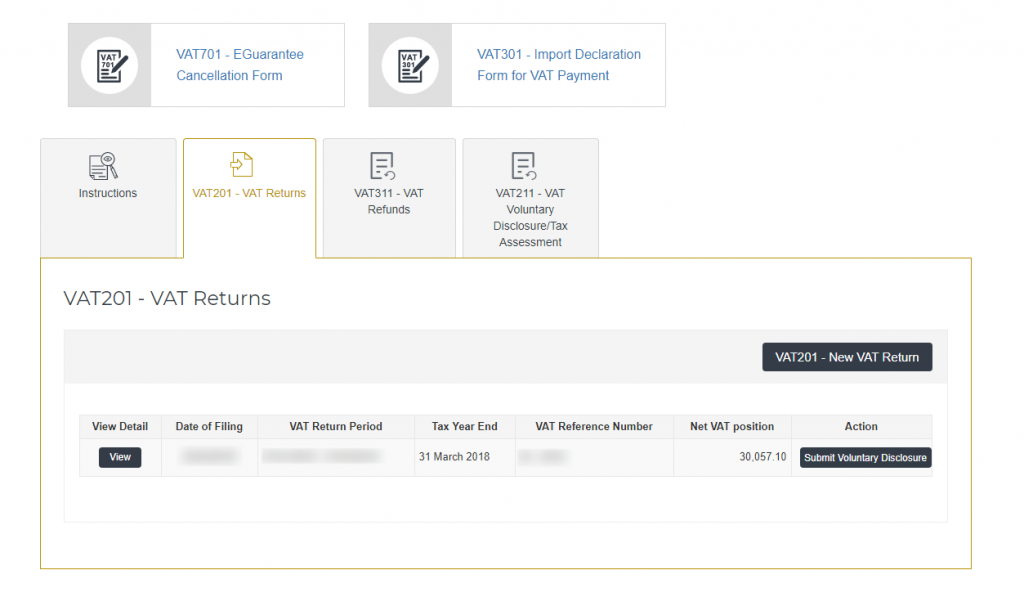

VAT UAE : Voluntary Disclosure Form 211: The Federal Tax Authority (FTA) has introduced a form, VAT voluntary disclosure form- 211 to rectify the errors they committed in their UAE VAT return Form [201]. This disclosure requirement has nothing to do with your VAT return or voluntary registration. The voluntary disclosure referred to is only to be used in the following circumstances if you later discover an error in a VAT return previously submitted.

The law says that if a taxable person becomes aware that a return submitted to the Federal Tax Authority is incorrect, resulting in a calculation of the payable tax being less than required by more than Dh10,000, they can make a voluntary disclosure to the authority within 20 business days once they become aware of the error. This is when you would use this tab and make a voluntary disclosure.

The only exception is If there is no later tax return after the error was discovered. This could occur if the registrant had made an error and then deregistered for VAT. In this case they should make

Saif Chartered Accountants, member of SGA World assures #1 VAT Return Filing Services across UAE.

Quick Contact