Corporate Tax UAE: Laws, Exemptions, and Registration

Corporate Tax UAE : Corporate tax is a type of tax that businesses must pay on the profits they make. In the UAE, the corporate tax system is relatively simple, as the government does not impose a federal corporate income tax on companies operating within the country. However, individual emirates have the power to impose corporate taxes at their discretion, and businesses may also be subject to other types of taxes, such as value-added tax (VAT) and customs duties. The UAE’s tax system is rapidly evolving, with significant changes happening in recent years, including the introduction of VAT and the implementation of transfer pricing regulations. It is essential for businesses planning to operate in the UAE to understand the details of corporate taxation in the country. This article aims to provide a comprehensive overview of corporate taxation in the UAE, including the various types of taxes businesses may face, applicable tax rates, and compliance requirements that businesses must follow.

Corporate Tax UAE

What are the deadlines for self-assessment and when are UAE companies required to pay the new corporate tax?

The Federal Tax Authority allows UAE businesses to submit their tax return and pay federal Corporate Tax within nine months (9) from the end of the relevant tax period.

Under the new UAE corporate tax system, business profits are subject to a standard rate of 9%, while taxable profits up to AED 375,000 are taxed at a 0% rate.

The UAE corporate tax will be effective for financial years starting on or after June 1, 2023.

Taxpayers under the new corporate tax regime in the UAE are given a generous time frame of up to 21 months from the start of their financial year to prepare for filing and making tax payments, which allows for adequate time for compliance.

For instance, if a business has a financial year starting on June 1, 2023, and ending on May 31, 2024, it will have from June 1, 2024, to February 28, 2025, to file its corporate tax returns and make payments.

Who is subject to Corporate Tax UAE?

Broadly, Corporate Tax applies to the following “Taxable Persons”:

UAE companies and other juridical persons that are incorporated or effectively managed and controlled in the UAE;

Natural persons (individuals) who conduct a Business or Business Activity in the UAE as specified in a Cabinet Decision to be issued in due course; and

Non-resident juridical persons (foreign legal entities) that have a Permanent Establishment in the UAE (which is explained under Section 8).

Corporate Tax applies to juridical persons established in a UAE Free Zone as “Taxable Persons,” and they must adhere to the Corporate Tax Law’s provisions. Nonetheless, a Free Zone Person that meets the criteria to be recognized as a Qualifying Free Zone Person is eligible for a 0% Corporate Tax rate on their Qualifying Income. The conditions for being a Qualifying Free Zone Person are provided in Section 14.

Non-resident persons without a Permanent Establishment in the UAE or those earning UAE sourced income unrelated to their Permanent Establishment may be liable to Withholding Tax, which is levied at a rate of 0%. Withholding Tax is a type of Corporate Tax that is deducted at the source by the payer on behalf of the income recipient. This tax is commonly used in various tax systems and usually applies to the international payment of dividends, interest, royalties, and other income types.

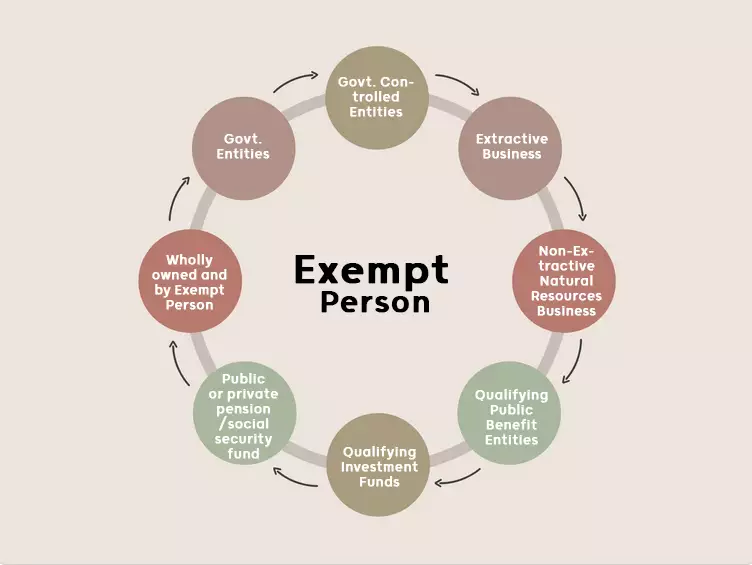

Who is exempt from Corporate Tax?

There are certain types of businesses or organizations called Exempt Persons that are crucial to the social and economic well-being of the UAE and are therefore exempt from Corporate Tax.

Automatic Exemption from UAE Corporate Tax Law

Under the UAE Corporate Tax Law, certain individuals or entities may be automatically exempt from paying Corporate Tax. This indicates that the law explicitly states that particular groups of people are not required to pay taxes under the Law. One such example is the exemption of a Government Entity and a Government Controlled Entity, who are considered Exempt Persons based on the automatic application of the law.

Exemption claimed through application

Under the UAE Corporate Tax Law, a Taxable Person has the option to apply for an exemption from Corporate Tax through the relevant provisions. Such entities can request an exemption, and the Federal Tax Authority will review their application and consider granting an exemption after certain conditions have been met.

| Entity | Type of Exemption |

|---|---|

| A Government Entity | Automatic Exemption |

| A Qualifying Public Benefit Entity | Automatic Exemption |

| A Government Controlled Entity | Automatic Exemption |

| A person engaged in the Non-Extractive Natural Resources Business | Automatic Exemption |

| A Qualifying Investment Fund | Exemption on application |

| A public pension fund, or a social security fund, or a private pension fund or a social security fund | Exemption on application |

| A juridical person entirely owned and controlled by certain Exempt Persons | Exemption on application |

Qualifying Free Zone Person

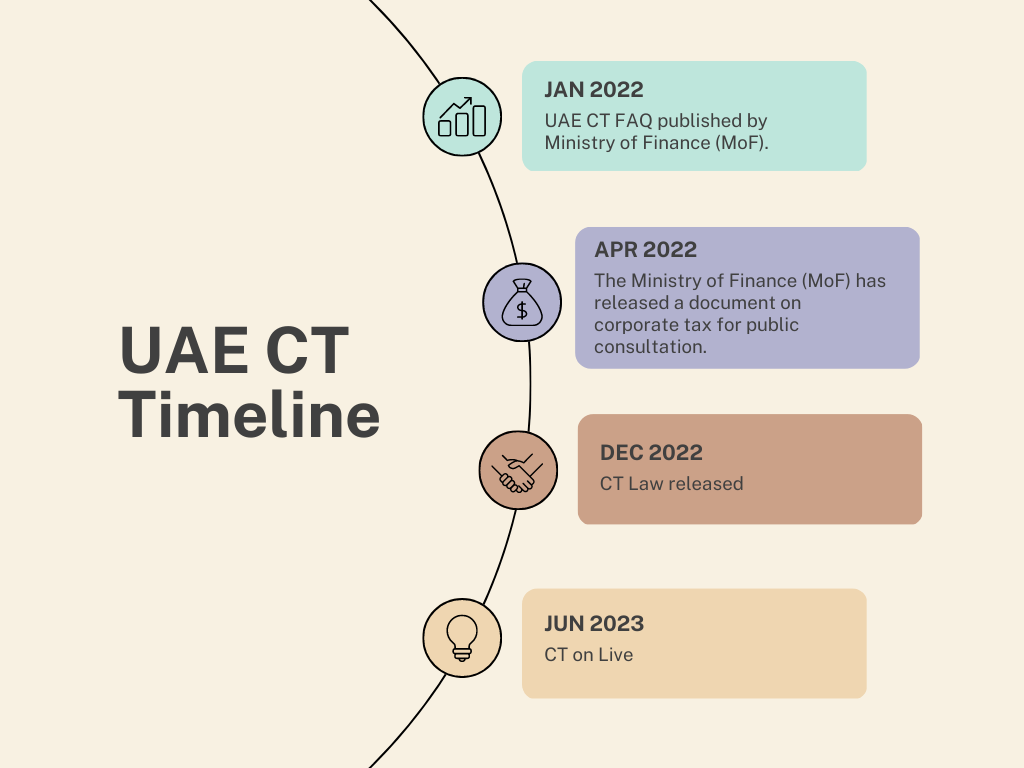

On January 31, 2022, when the CT regime was introduced, the UAE Ministry of Finance (MoF) declared their commitment to honoring tax incentives available to entities in the Free Zones of the UAE. Later, on April 28, 2022, a Public Consultation Document was issued, which offered insights into the new federal tax law and clarified that entities in Free Zones would fall under the scope of CT and would need to register under the regime and file tax returns. Nonetheless, they would be qualified for a 0% CT rate, subject to meeting specified conditions related to maintaining substance and complying with the respective Free Zone regulations.

As per the said document, the following income of Free Zone persons would be subject to 0% CT:

Income from outside UAE or from other Free Zones

Passive income from mainland companies (royalties, interest, etc.)

Income from group companies in the mainland is subject to a disallowance of expenses in the hands of mainland companies.

The document also stated that if Free Zone individuals do not satisfy the necessary conditions or generate any other income from the mainland, they would lose their exemption status, and their entire income would become subject to CT. The taxation of the entire income in the event of a breach of the condition seemed severe for companies with revenue from the mainland.

Corporate Tax UAE Registration

All Taxable persons, including Exempt entities that engage in non-exempt business activities, unincorporated partnerships (if chosen), and family foundations (if involved in other business activities), are required to register for UAE Corporate Tax Law.

A comprehensive guide on how to register UAE CT

What are the deductible expenses in CT (Corporate Tax)

Deductible expenses in CT (Corporate Tax) refer to the expenses incurred by a business or entity that can be subtracted from their total taxable income. These expenses include costs related to the business’s operations, such as salaries and wages, rent, utilities, and other general expenses. Other deductible expenses may include expenses related to depreciation, bad debts, and certain charitable donations. By deducting these expenses from their taxable income, businesses can reduce the amount of CT they owe to the government.

Deductions allowed: Non-capital business expenses, Entertainment expenses, Owner’s remuneration at market value, Proportional expenses incurred to generate taxable income, Interest expenses.

Deduction not allowed: Expenses related to exempt business, Non-business expenses, Losses not related to the taxable person’s business.

Entertainment Expenditure

50% of entertainment expenses are deductible. Entertainment include the followings

- Meals.

- Accommodation.

- Transportation.

- Admission fees.

- Facilities and equipment used in connection with such entertainment, amusement or recreation

Non-Deductible Expenses

- Donations, grants or gifts to a non-qualifying Public Benefit Entity.

- Fines and penalties

- Bribes or other illicit payments.

- Dividends, profit distributions to the owner of the Taxable Person.

- Amounts withdrawn by taxable natural person or partner in unincorporated partnership.

- Corporate Tax imposed

- Recoverable Input VAT.

- Tax on income imposed on the Taxable Person outside the State.

Do You Require Help With Filing Your Corporate Tax Return in the UAE?

Our service includes a thorough review and expert advice on the applicability of corporate tax in the UAE., Corporate Tax Registration, Filing Corporate Tax Return,