VAT De-registration in UAE, How to do?

Taxable persons/companies must apply for VAT De-registration if they fulfill any of the conditions laid down by the law.

- Cease making taxable supplies; or are still making taxable supplies but the value in the preceding 12 calendar months is less than the Voluntary Registration Threshold, must apply for de-registration within 20 business days from the occurrence of the event

- Are still making taxable supplies but the value in the previous 12 months was less than the Mandatory Registration Threshold; and, 12 months have elapsed since the date of registration if you were registered on a voluntary basis –may apply for a voluntary de-registration

VAT De-registration in UAE, How to do?

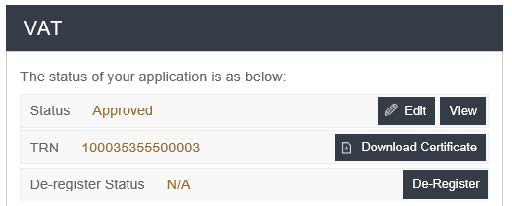

On the dashboard, against the VAT registration, click on the ‘De-Register’ button.

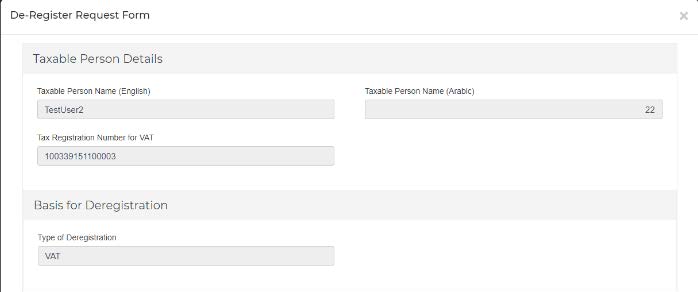

How do I complete the de-registration application form?

- Taxable Person Details are pre-populated in the de-registration application

- Provide the reasons and effective date for de-registration

- Please select from the dropdown list the basis you are de-registering for VAT, i.e.

- Business no longer making taxable supplies

- Business making taxable supplies, but below the Voluntary Threshold

- Business making taxable supplies, above the Voluntary Threshold, but below the Mandatory Threshold

- Please select from the dropdown list the basis you are de-registering for VAT, i.e.

- Provide the details on the basis for the de-registration.

- The date from which the Taxable Person is required or eligible to de-register depends on the basis of the de-registration:

- the Business is no longer making taxable supplies,the date starting from which the Taxable Person stopped making taxable supplies

- the Business is making taxable supplies, but below the Voluntary Registration Threshold, the date starting from which the value of the Taxable Person’s taxable supplies no longer exceed the Voluntary Registration Threshold

- the Business is making taxable supplies, above the Voluntary Threshold, but below the Mandatory Registration Threshold, a preferred de-registration date

- any other reason, a relevant date you consider you are required to de-register

Upload all the relevant supporting documents by clicking on ‘Choose Files’.

Review and confirm the authorized signatory and declaration section of the application form before submission

It is important to update the email credentials for authorized signatory (where necessary) and confirm all the four declarations by ticking the check box next to each. Once you have completed the above, click on the ‘Submit’ button to proceed.

Once the de-registration request is submitted, the FTA shall approve or reject the request and notify the registrant accordingly. Further, the FTA may ask you to provide additional supporting documents

IMPORTANT: Please note, if the date of submission of this de-registration form is more than 20 business days from the date the Taxable Person is required to de-register then you will be subject to a late de-registration penalty of AED 10,000.

Once your application is submitted, the status of your application form will be amended to “pending”. You may check your application status in the dashboard from time to time.

Once the FTA confirms acceptance of your de-registration application form, you will be notified of the pre-approval. The status of your de-registration in the dashboard will be changed to ‘Pre-Approved’.

You may also be required to submit a final tax return which will be generated by the system in the “VAT returns” section. You will receive an email and an SMS notification informing you of the status of the application and requesting you to complete the payment of the outstanding liabilities.

Please note, you will not be deregistered unless you’ve paid all Tax and Administrative Penalties due and filed all Tax Returns including any outstanding returns as well as the final tax return.

Related : VAT DeRegistration in UAE