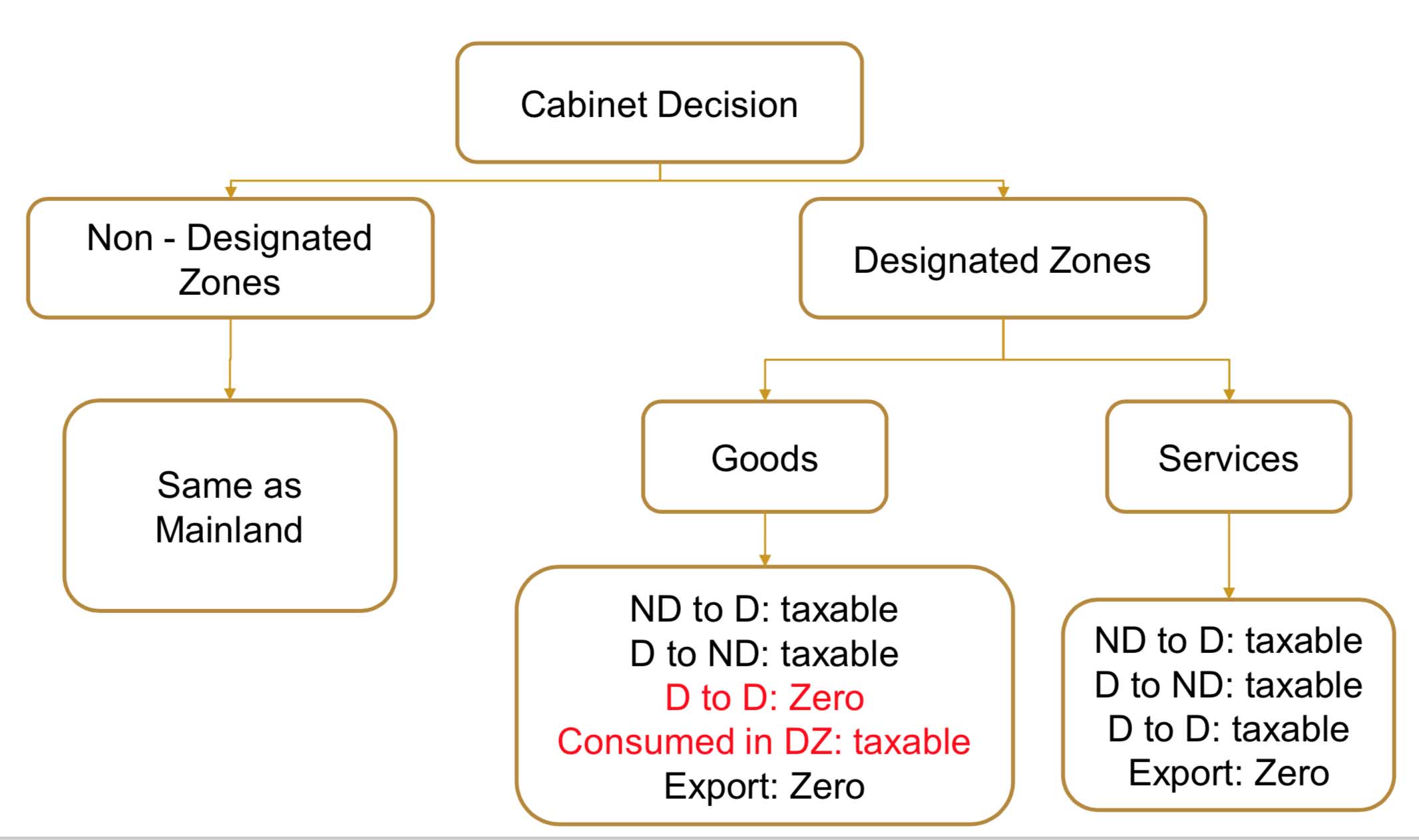

Free Zones -VAT

Tax Treatment in Mainland and Non-designated Zones:

| No | Event | Impact on “a” |

|---|---|---|

| 1 | Supplier “b” inside the State makes supplies to company “a” and charges 5% VAT that will be paid by company “a” |

No impact, if A is registered. 5%, if A is not-registered. |

| 2 | Exporter into the State “c” , is outside the State, makes supplies to company “a” inside the State. Company “a” accounts for VAT and deducts the same via its tax return according to the reverse charge mechanism. |

– |

| 3 | Company “a” exports goods or services to Company “d” located outside the State. This supply is zero- rated. |

– |

| 4 | Company “a” made supplies inside the State and charges 5% VAT and collect tax on behalf of government. | – |

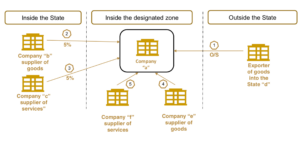

Designated Zone Companies – Inputs:

Tax Treatment for Designated Zone Companies – Company Inputs

| No | Satement | Impact on “a” |

|---|---|---|

| 1 | Exporter “d” from outside the state, makes supplies of goods to company “a” located in the designated zone without charging for VAT. Transaction is deemed performed outside the State. |

– |

| 2 | Company “b”, a supplier of goods inside the State, makes supplies to company “a” located in the designated zone. Company “b” charges 5% VAT to company “a” and collects tax on behalf of the government. |

No impact, if the company is registered. 5%, if the company is a not-registered. |

| 3 | Company “c” makes supplies of services that will be used inside the State, to company “a” located in the designated zone (e.g.: insurance). Company “c” charges 5% of VAT to company “a”. |

No impact, if the company is registered. 5%, if the company is a not-registered. |

| 4 | Company “e” supplies goods to company “a” inside the designated zone. No VAT is charged. |

– |

| 5 | 5,Company “f” supplies services to company “a” inside the designated zone. Company “f” charges 5% of VAT to company “a” . |

No impact, if the company is registered. 5%, if the company is a not-registered. |

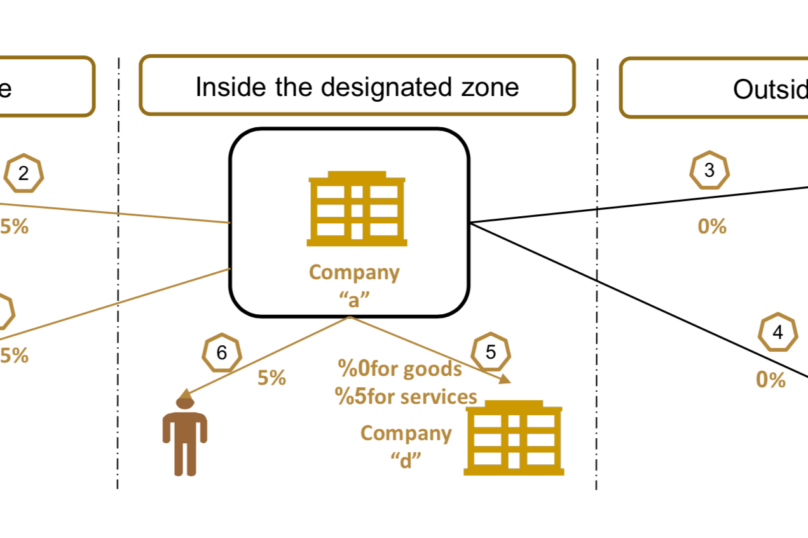

Designated Zone Companies – Outputs:

| No | Satement | Impact on “a” |

|---|---|---|

| 1 | Company “a” makes supplies of goods or services to company “b”, which is a registered recipient inside the State: If Company “a” is registered, 5% is charged (either by A or on import) If Company “a” is not registered: no tax for services, and import VAT shall be charged on import to Mainland. |

– |

| 2 | Company “a” makes supplies of goods or services to individual, (i.e. recipient who is not registered inside the State): If Company “a” is registered: it charge 5% of VAT to the individual. If Company “a” is not registered: tax shall be charged at customs point for goods. Companies not registered should not provide services. |

– |

| 3 | Company “a” in the designated zone made supplies to company “c” outside the State. No VAT shall be charged. |

– |

| 4 | Company “a” in the designated zone makes supplies to consumer. No VAT shall be charged. |

– |

| 5 | Company “a” in the designated zone makes supplies of goods in the designated zone to company “d” located inside the designated zone without charging VAT. Company “a” in the designated zone makes supplies of services in the designated zone to company “d” located inside the designated zone and charges 5% VAT on behalf of government. |

– |

| 6 | Company “a” in the designated zone makes supplies into the designated zone to a consumer. The company charges 5% VAT and collects it on behalf of government. |