UAE Corporate Tax Registration -The Complete Guide

A Guide to UAE Corporate Tax Registration on Emaratax Platform

UAE Corporate Tax Registration : The Federal Tax Authority (FTA) has opened the pre-registration process for certain companies and entities. Businesses that come within the scope of this notification must register for UAE corporate tax in line with guidance issued by the FTA.

Corporate tax consultants/VAT Consultants/Tax Consultants like us in Dubai can help businesses determine whether or not a notification applies to them. We can also guide businesses on how to register for UAE corporate tax through the EmaraTax platform.

UAE Corporate Tax online Registration Step-by-Step Tutorial

You can register for corporate tax in the following steps:

To log in to the EmaraTax account, use your login credentials or UAE Pass. If you do not have an EmaraTax account, you can sign-up for an account by clicking the ‘sign up button’

Login to emaratax : https://eservices.tax.gov.ae

- If you login via your registered email and password, on successful login, the EmaraTax online user dashboard will be displayed. If you had opted for 2 factor authentication, you will be required to enter the OTP received in your registered email and mobile number to successfully login.

- If you wish to login via UAE Pass, you will be redirected to UAE Pass. On successful UAE Pass login, you will be redirected back to the EmaraTax online user dashboard

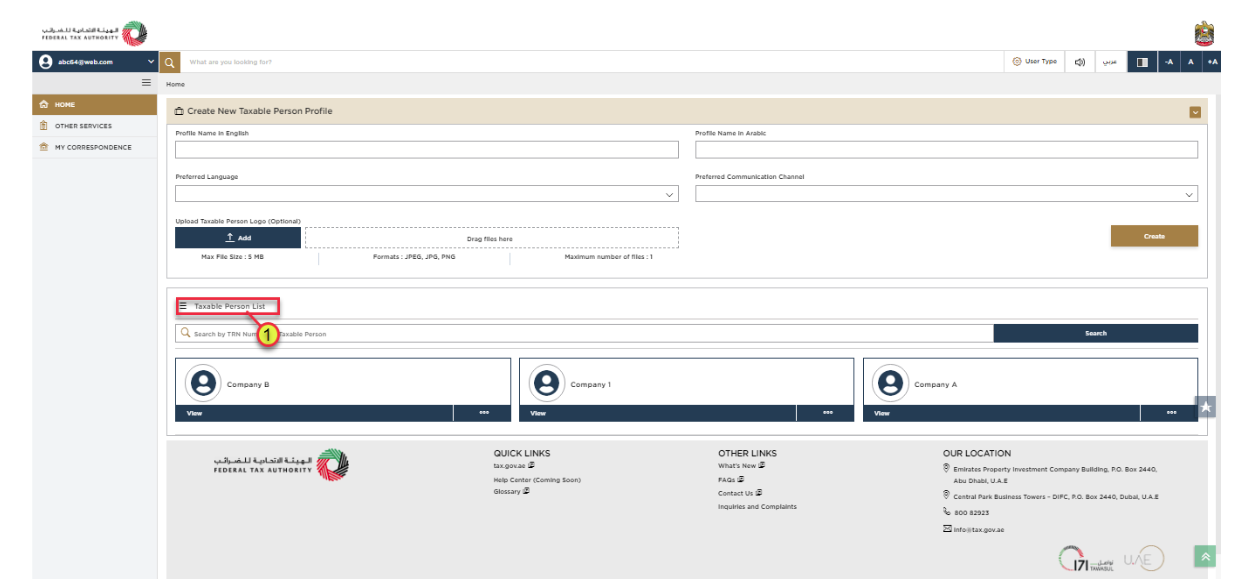

Upon successful login, the Taxable Person list screen is displayed. It displays a list of all Taxable Persons linked to your EmaraTax user profile. If there are no Taxable Persons linked to your profile, this list will be empty and you will need to create one.

If there are no Taxable Person linked to your user profile, this list will be empty and you would need to create a Taxable) Person. To create a new Taxable Person, enter the mandatory details and click ‘Create’. The new Taxable Person will be displayed in the list.Select the Taxable Person from the list and click ‘View’ to open the dashboard.

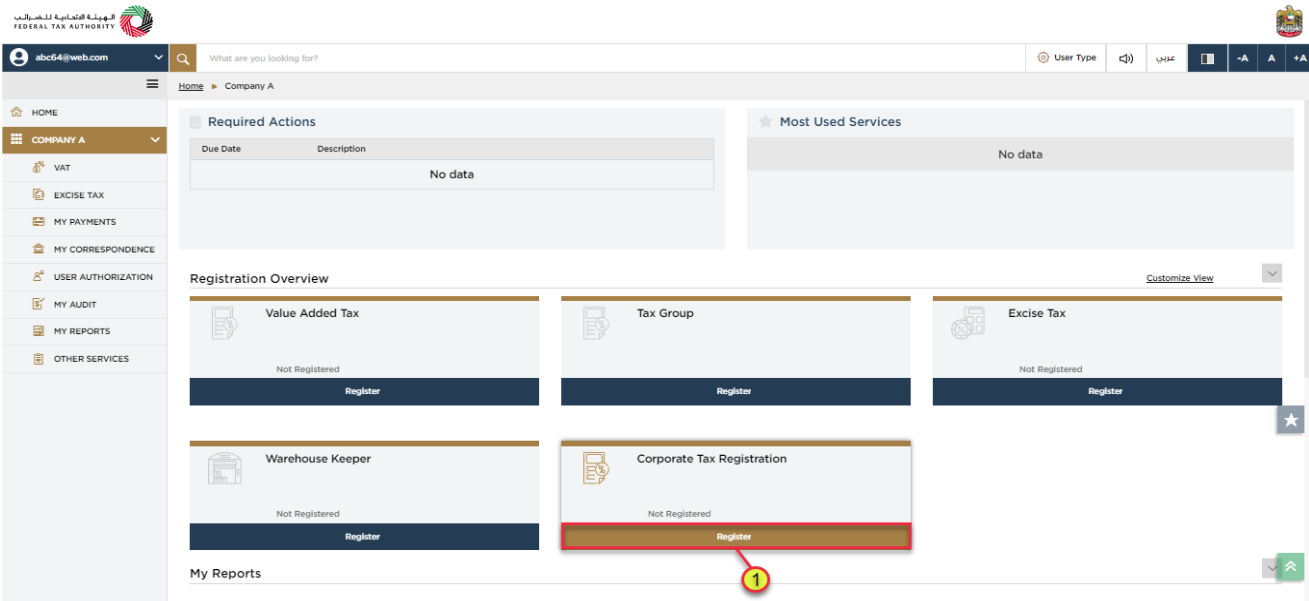

Click ‘Register’ on the Corporate Tax tile within the Taxable Person dashboard to initiate the Corporate Tax registration application.

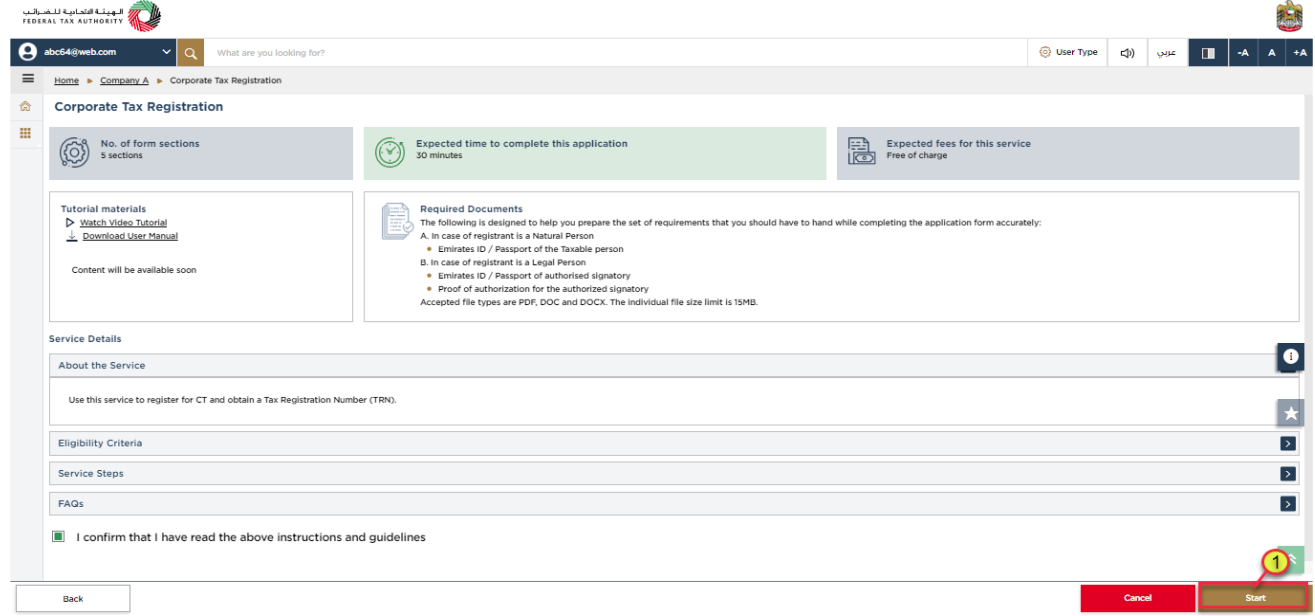

UAE Corporate Tax Registration : Guidelines And Instructions

The ‘guidelines and instructions’ page is designed to help you understand certain important requirements relating to CT registration in the UAE. It also provides guidance on what information you should have in hand when you are completing the CT registration application.

A screen will appear with instructions and guidelines for CT registration. Read the guidelines and instructions, then check the box to confirm your understanding and click ‘Start’ to initiate the CT Registration application.

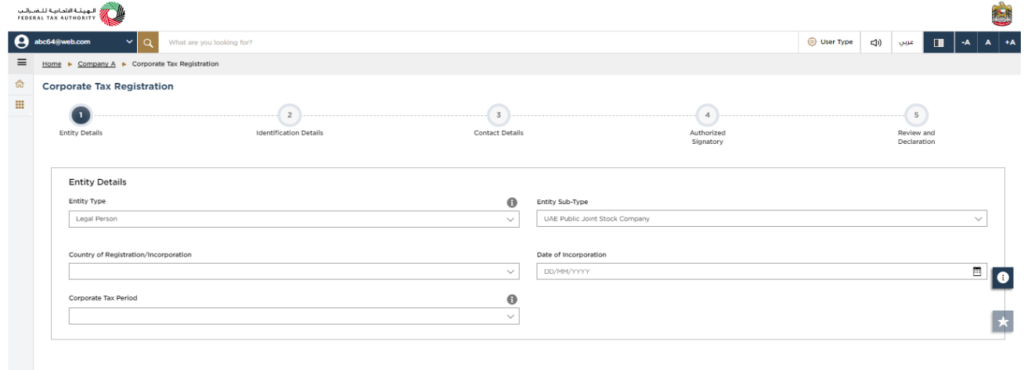

Entity Details Section

- The application is divided into a number of short sections which deal with various aspects of the registration process. The progress bar displays the number of sections required to complete the application. The section you are currently in, is highlighted as blue. Once you progress to the next section successfully, the previous section will be highlighted as green.

- You are requested to ensure that the documents submitted, support the information entered by you in the application. This would help to avoid any rejection or re submission of the application late.

Step Action

Select the Entity Type of your business from the list in the entity details section. Note that the input fields in this section may vary based on the entity type selected.

You will be able to see the following list of entity types and respective sub-types in the application:

? Legal Person – UAE Public Joint Stock Company

? Legal Person – UAE Private Company (incl. an Establishment)

? Legal Person – UAE Partnership

? Legal Person – Foreign Company

? Legal Person – Club or Association or Society

? Legal Person – Trust

? Legal Person – Charity

? Legal Person – Foundation

? Legal Person – Federal Government Entity

? Legal Person – Emirate Government Entity

? Legal Person – Other

? Natural Person – Individual

? Natural Person – Sole Proprietorship/Establishment or Civil Company

? Natural Person – Partner in a Partnership

? Natural Person – Other

However, registration is currently only available for the below entity and sub-types:

? Legal Person – UAE Public Joint Stock Company

? Legal Person – UAE Private Company (incl. an Establishment)

You may click on ‘Save as draft’ to save your application and return to continue working on your application later. After completing all the mandatory fields, click ‘Next Step’ to save and proceed to the ‘Identification Details’ section

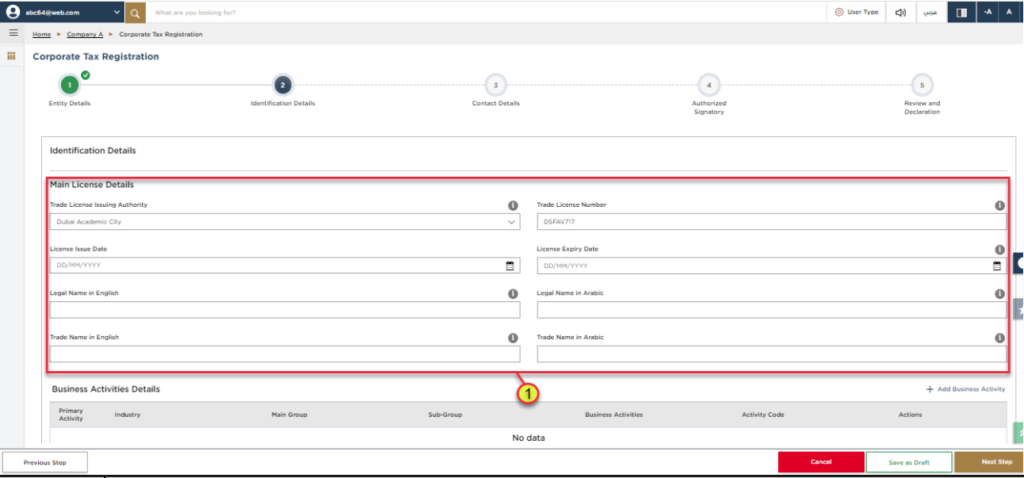

Identification Details

Depending on the ‘Entity Type’ selected, you are required to provide the main trade license details in the identification details section

Click on ‘Add Business Activities’ to enter all the business activity information associated with the trade license.. Enter the mandatory business activity information and click on Add.

Ensure that the information about all your business activities is included. The activity code will get populated on the screen. Click on ‘Add Owners’ to enter all the owners that have a 25% or more ownership in the entity being registered.

enter the trade license details and associated business activities and owners list. The registration will be in the name of head office meeting the relevant criteria. Registration will not be performed in the name of Branch. Even if you are operating via branches in more than one Emirate, only one CT registration is required.

After completing all mandatory fields, click ‘Next Step’ to save and proceed to the ‘Contact Details’ section. Enter the registered address details of the business. Do not use another company’s address (for example, your accountant). If you have multiple addresses, provide details of the place where most of the day-to-day activities of the business are carried out.

IF YOU ARE A FOREIGN BUSINESS APPLYING TO REGISTER FOR UAE CT, YOU MAY CHOOSE TO APPOINT A TAX AGENT IN THE UAE. IN SUCH CASES, PROVIDE THE NECESSARY DETAILS.

After completing all mandatory fields, click ‘Next Step’ to save and proceed to the ‘Authorized Signatory’ section. After entering the required information for an Authorized Signatory, click ‘Add’. Evidence of authorization may include a Power of Attorney or Memorandum of Association in the case of legal persons. You can add one or more Authorized Signatory, if required.

After completing all mandatory fields, click ‘Next Step’ to save and proceed to the ‘Review and Declaration’ section. Click ‘Submit’ to submit the Corporate Tax Registration application. After your application is submitted successfully, a Reference Number is generated for your submitted application. Note this reference number for future communication with FTA

LOOKING FOR SUPPORT : CONTACT US

Related: UAE CT , UAE CT Consultants, UAE Corporate Tax Rate